Are you looking to invest in the metal fabrication industry but want to focus on companies that are publicly traded? Then you need to learn about publicly traded metal fabrication companies.

Editor’s Note: Publicly traded metal fabrication companies are a great investment opportunity for those looking to get involved in the metal fabrication industry. These companies are traded on stock exchanges, making them easy to buy and sell. They also offer investors the potential for high returns.

We’ve done the analysis, dug through the information, and put together this guide to publicly traded metal fabrication companies to help you make the right decision. We’ll cover the key differences between publicly traded and privately held companies, the pros and cons of investing in each, and some of the best publicly traded metal fabrication companies to consider.

| Characteristic | Publicly Traded Companies | Privately Held Companies |

|---|---|---|

| Ownership | Owned by shareholders | Owned by a small group of individuals or families |

| Transparency | Required to disclose financial information to the public | Not required to disclose financial information to the public |

| Regulation | Heavily regulated by the SEC | Less regulated than publicly traded companies |

| Access to capital | Can raise capital by issuing stock | Limited access to capital |

Now that you know the key differences between publicly traded and privately held companies, you can make an informed decision about which type of company is right for you.

If you’re looking for a high-growth investment with the potential for high returns, then publicly traded metal fabrication companies may be a good option for you. However, if you’re looking for a more stable investment with less risk, then privately held companies may be a better choice.

No matter which type of company you choose, it’s important to do your research and make sure that you understand the risks involved. Investing in any type of company can be risky, so it’s important to weigh the risks and rewards before making a decision.

Publicly Traded Metal Fabrication Companies

Publicly traded metal fabrication companies are a key part of the global economy. They play a vital role in the production of a wide range of products, from cars and appliances to buildings and bridges. Here are 12 key aspects of publicly traded metal fabrication companies:

- Size: Publicly traded metal fabrication companies can range in size from small businesses to large corporations.

- Location: Publicly traded metal fabrication companies can be found all over the world.

- Products: Publicly traded metal fabrication companies produce a wide range of products, including structural steel, plate steel, and fabricated metal products.

- Services: Publicly traded metal fabrication companies offer a variety of services, including cutting, welding, and forming.

- Customers: Publicly traded metal fabrication companies sell their products and services to a variety of customers, including construction companies, manufacturers, and other businesses.

- Competition: Publicly traded metal fabrication companies face competition from both domestic and international companies.

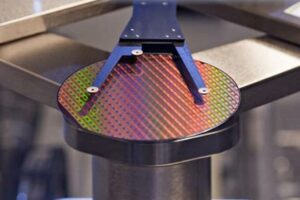

- Technology: Publicly traded metal fabrication companies use a variety of technologies to produce their products and services.

- Regulation: Publicly traded metal fabrication companies are subject to a variety of regulations, both at the state and federal level.

- Investment: Publicly traded metal fabrication companies can be a good investment for investors looking for long-term growth.

- Risk: Investing in publicly traded metal fabrication companies involves some risk, as with any investment.

- Reward: The potential reward for investing in publicly traded metal fabrication companies can be significant.

- Impact: Publicly traded metal fabrication companies have a significant impact on the global economy.

These are just a few of the key aspects of publicly traded metal fabrication companies. By understanding these aspects, investors can make informed decisions about whether or not to invest in these companies.

Size

The size of a publicly traded metal fabrication company can have a significant impact on its operations and financial performance. Smaller companies may be more agile and responsive to market changes, while larger companies may have more resources and economies of scale. Here are some of the key differences between small and large publicly traded metal fabrication companies:

Small publicly traded metal fabrication companies

- Typically have annual revenues of less than $50 million.

- May be family-owned or operated.

- Often have a regional or local focus.

- May be more specialized in a particular type of metal fabrication.

- May be more flexible and responsive to customer needs.

Large publicly traded metal fabrication companies

- Typically have annual revenues of more than $50 million.

- May be publicly traded on a stock exchange.

- Often have a national or international presence.

- May offer a wide range of metal fabrication services.

- May have more resources and economies of scale.

The size of a publicly traded metal fabrication company is an important factor to consider when making investment decisions. Investors should consider the company’s size in relation to its industry, its competitors, and its financial performance.

Here is a table summarizing the key differences between small and large publicly traded metal fabrication companies:

| Characteristic | Small Companies | Large Companies |

|---|---|---|

| Annual revenues | Less than $50 million | More than $50 million |

| Ownership | Family-owned or operated | Publicly traded |

| Focus | Regional or local | National or international |

| Specialization | May be more specialized | Offer a wide range of services |

| Flexibility | More flexible and responsive | May be less flexible |

Location

The location of a publicly traded metal fabrication company can have a significant impact on its operations and financial performance. Companies located in areas with a strong manufacturing base may have access to a larger pool of skilled labor and lower costs. Companies located in areas with a strong transportation infrastructure may have lower shipping costs. And companies located in areas with favorable tax laws may have lower operating costs.

Here are some of the key factors that companies consider when choosing a location:

- Availability of skilled labor: Metal fabrication is a skilled trade, and companies need access to a pool of qualified workers. Areas with a strong manufacturing base typically have a larger pool of skilled labor available.

- Cost of labor: Labor costs can vary significantly from one location to another. Companies may choose to locate in areas with lower labor costs to reduce their operating expenses.

- Transportation infrastructure: Metal fabrication companies need to be able to transport their products to their customers. Areas with a strong transportation infrastructure make it easier and less expensive to ship products.

- Tax laws: Tax laws can vary significantly from one location to another. Companies may choose to locate in areas with favorable tax laws to reduce their tax burden.

The location of a publicly traded metal fabrication company is an important factor to consider when making investment decisions. Investors should consider the company’s location in relation to its industry, its competitors, and its financial performance.

Products

The products that publicly traded metal fabrication companies produce are essential to a wide range of industries, including construction, manufacturing, and transportation. Structural steel is used in the construction of buildings, bridges, and other structures. Plate steel is used in the production of ships, tanks, and other vessels. Fabricated metal products are used in a variety of applications, including automotive parts, appliances, and furniture.

The production of these products requires a high level of expertise and precision. Publicly traded metal fabrication companies have invested heavily in state-of-the-art equipment and technology to ensure that their products meet the highest quality standards.

The products that publicly traded metal fabrication companies produce are essential to the global economy. These products are used in a wide range of applications, and they play a vital role in the construction, manufacturing, and transportation industries.

Here is a table that provides more detail on the products that publicly traded metal fabrication companies produce:

| Product | Description | Applications |

|---|---|---|

| Structural steel | Steel that is used in the construction of buildings, bridges, and other structures. | Buildings, bridges, stadiums, skyscrapers |

| Plate steel | Steel that is used in the production of ships, tanks, and other vessels. | Ships, tanks, boilers, pressure vessels |

| Fabricated metal products | Metal products that are used in a variety of applications, including automotive parts, appliances, and furniture. | Automotive parts, appliances, furniture, machinery |

Services

The services offered by publicly traded metal fabrication companies are essential to the production of a wide range of products. Cutting, welding, and forming are three of the most important services offered by these companies. Cutting is used to cut metal into specific shapes and sizes. Welding is used to join pieces of metal together. Forming is used to shape metal into specific shapes.

Publicly traded metal fabrication companies use a variety of technologies to perform these services. These technologies include laser cutting, waterjet cutting, plasma cutting, and welding robots. These technologies allow companies to produce high-quality products quickly and efficiently.

The services offered by publicly traded metal fabrication companies are essential to the global economy. These services are used in a wide range of industries, including construction, manufacturing, and transportation. By providing these services, publicly traded metal fabrication companies play a vital role in the production of a wide range of products that we use every day.

Here is a table that provides more detail on the services offered by publicly traded metal fabrication companies:

| Service | Description | Applications |

|---|---|---|

| Cutting | Used to cut metal into specific shapes and sizes. | Construction, manufacturing, transportation |

| Welding | Used to join pieces of metal together. | Construction, manufacturing, transportation |

| Forming | Used to shape metal into specific shapes. | Construction, manufacturing, transportation |

Customers

Publicly traded metal fabrication companies play a vital role in the global economy by providing essential products and services to a wide range of customers. These customers include construction companies, manufacturers, and other businesses that rely on metal fabrication to build their products or provide their services.

- Construction companies use metal fabrication services to create structural steel frames for buildings, bridges, and other structures. They also use metal fabrication services to produce metal roofing, siding, and other building components.

- Manufacturers use metal fabrication services to create a variety of products, including automotive parts, appliances, and furniture. They also use metal fabrication services to produce machinery and equipment.

- Other businesses use metal fabrication services to create a variety of products and components, including retail fixtures, displays, and signage. They also use metal fabrication services to repair and maintain their equipment.

The products and services provided by publicly traded metal fabrication companies are essential to the global economy. These companies play a vital role in the construction, manufacturing, and transportation industries. By providing high-quality products and services, publicly traded metal fabrication companies help their customers to build better products, provide better services, and grow their businesses.

Competition

The metal fabrication industry is a highly competitive one, with both domestic and international companies vying for market share. This competition has a significant impact on the operations and financial performance of publicly traded metal fabrication companies.

Domestic competition comes from other metal fabrication companies that are based in the same country. These companies may offer similar products and services, and they may compete on price, quality, or customer service. International competition comes from metal fabrication companies that are based in other countries. These companies may have lower labor costs or other advantages that allow them to offer their products and services at a lower price.

Publicly traded metal fabrication companies must constantly innovate and improve their operations in order to stay ahead of the competition. They must also be able to adapt to changing market conditions, such as fluctuations in the price of raw materials or changes in customer demand.

The following are some of the key challenges that publicly traded metal fabrication companies face due to competition:

- Price pressure: Competition from both domestic and international companies can lead to downward pressure on prices. This can make it difficult for publicly traded metal fabrication companies to maintain their profit margins.

- Need to innovate: In order to stay ahead of the competition, publicly traded metal fabrication companies must constantly innovate and improve their products and services. This can be a costly and time-consuming process.

- Need to adapt to changing market conditions: Publicly traded metal fabrication companies must be able to adapt to changing market conditions, such as fluctuations in the price of raw materials or changes in customer demand. This can be a challenge, especially for companies that are heavily dependent on a particular industry or customer base.

Despite the challenges, competition can also be a positive force for publicly traded metal fabrication companies. Competition can drive innovation, improve efficiency, and lower prices for consumers. Publicly traded metal fabrication companies that are able to successfully compete in the global marketplace are well-positioned for long-term success.

| Challenge | Impact |

|---|---|

| Price pressure | Can lead to downward pressure on prices, making it difficult to maintain profit margins. |

| Need to innovate | Can be a costly and time-consuming process. |

| Need to adapt to changing market conditions | Can be a challenge, especially for companies that are heavily dependent on a particular industry or customer base. |

Technology

Technology plays a vital role in the success of publicly traded metal fabrication companies. These companies use a variety of technologies to produce their products and services, including computer-aided design (CAD), computer-aided manufacturing (CAM), and robotics. These technologies allow companies to produce high-quality products quickly and efficiently.

- CAD/CAM: CAD/CAM is a powerful tool that allows engineers and designers to create detailed models of products. These models can then be used to generate instructions for CNC machines, which can produce parts with high precision and accuracy.

- Robotics: Robots are increasingly being used in metal fabrication to perform repetitive tasks, such as welding and assembly. This can free up human workers to focus on more complex tasks, such as quality control and product development.

- Additive manufacturing: Additive manufacturing, also known as 3D printing, is a relatively new technology that is gaining popularity in the metal fabrication industry. This technology allows companies to create complex parts that would be difficult or impossible to produce using traditional methods.

- Virtual reality (VR) and augmented reality (AR): VR and AR are being used to improve the training of metal fabrication workers. These technologies can create immersive simulations that allow workers to practice their skills in a safe and controlled environment.

The use of technology is essential for the success of publicly traded metal fabrication companies. These companies must constantly invest in new technologies in order to stay ahead of the competition and meet the demands of their customers.

Regulation

Publicly traded metal fabrication companies are subject to a variety of regulations, both at the state and federal level. These regulations are designed to protect the public, the environment, and the workers in the metal fabrication industry. They cover a wide range of topics, including environmental protection, worker safety, and product quality.

- Environmental protection: Metal fabrication companies are subject to a variety of environmental regulations. These regulations are designed to protect the environment from the harmful effects of metal fabrication activities. They cover a wide range of topics, including air pollution, water pollution, and hazardous waste management.

- Worker safety: Metal fabrication companies are subject to a variety of worker safety regulations. These regulations are designed to protect workers from the hazards of metal fabrication activities. They cover a wide range of topics, including machine guarding, hazardous materials handling, and personal protective equipment.

- Product quality: Metal fabrication companies are subject to a variety of product quality regulations. These regulations are designed to ensure that metal fabrication products meet safety and performance standards. They cover a wide range of topics, including product testing, inspection, and certification.

- Financial reporting: Publicly traded metal fabrication companies are subject to a variety of financial reporting regulations. These regulations are designed to ensure that companies provide accurate and transparent financial information to investors. They cover a wide range of topics, including financial statement preparation, disclosure requirements, and internal controls.

The regulations that publicly traded metal fabrication companies are subject to can have a significant impact on their operations and financial performance. Companies must comply with these regulations in order to avoid fines, penalties, and other legal liabilities. They must also factor the cost of compliance into their business plans.

Despite the challenges, regulation is essential to protect the public, the environment, and the workers in the metal fabrication industry. Publicly traded metal fabrication companies play a vital role in the global economy, and they must be held to a high standard of accountability.

Investment

Publicly traded metal fabrication companies play a vital role in the global economy. They produce the essential products and services that are used in a wide range of industries, including construction, manufacturing, and transportation. As a result, these companies can be a good investment for investors looking for long-term growth.

There are a number of factors that make publicly traded metal fabrication companies attractive to investors.

- Strong demand for metal fabrication products and services: The demand for metal fabrication products and services is expected to grow in the coming years, as the global economy continues to expand. This growth will be driven by a number of factors, including the increasing use of metal in construction and manufacturing.

- High barriers to entry: The metal fabrication industry is characterized by high barriers to entry. This is due to the high cost of capital required to start a metal fabrication company. As a result, it is difficult for new companies to enter the market and compete with established players.

- Experienced management teams: Publicly traded metal fabrication companies are typically managed by experienced teams with a deep understanding of the industry. This experience can be a valuable asset, as it allows companies to navigate the challenges of the industry and make sound investment decisions.

Of course, there are also some risks associated with investing in publicly traded metal fabrication companies. These risks include:

- Economic downturns: The metal fabrication industry is cyclical, and it is affected by economic downturns. During an economic downturn, demand for metal fabrication products and services can decline, which can lead to lower profits and stock prices.

- Competition: The metal fabrication industry is competitive, and companies face competition from both domestic and international players. This competition can put pressure on prices and profit margins.

- Raw material costs: The cost of raw materials, such as steel and aluminum, can fluctuate significantly. This can impact the profitability of metal fabrication companies.

Overall, publicly traded metal fabrication companies can be a good investment for investors looking for long-term growth. However, it is important to be aware of the risks involved before investing in these companies.

| Factor | Impact |

|---|---|

| Demand for metal fabrication products and services | Positive: Growing demand will drive revenue and earnings growth. |

| Barriers to entry | Positive: High barriers to entry protect incumbents from competition. |

| Experienced management teams | Positive: Experienced managers can navigate industry challenges and make sound investment decisions. |

| Economic downturns | Negative: Economic downturns can reduce demand for metal fabrication products and services. |

| Competition | Negative: Competition can pressure prices and profit margins. |

| Raw material costs | Negative: Fluctuating raw material costs can impact profitability. |

Risk

Investing in publicly traded metal fabrication companies, like any investment, carries some inherent risks. Understanding these risks is crucial before making investment decisions.

- Economic downturns: The metal fabrication industry is cyclical and can be affected by economic downturns. During such times, demand for metal fabrication products and services may decline, leading to lower profits and potentially reduced stock prices.

- Competition: The metal fabrication industry is competitive, with companies facing competition from both domestic and international players. This competition can put pressure on prices and profit margins, potentially impacting the financial performance of publicly traded metal fabrication companies.

- Raw material costs: The cost of raw materials, such as steel and aluminum, can fluctuate significantly. These fluctuations can impact the profitability of metal fabrication companies, as changes in raw material costs can affect production expenses and profit margins.

- Technological advancements: The metal fabrication industry is constantly evolving, with new technologies emerging regularly. These advancements can disrupt existing processes and business models, potentially posing challenges to publicly traded metal fabrication companies that fail to adapt or innovate accordingly.

It is important for investors to carefully consider these risks and conduct thorough research before investing in publicly traded metal fabrication companies. Diversification of investment portfolios and regular monitoring of market conditions can help mitigate some of these risks.

Reward

Investing in publicly traded metal fabrication companies offers the potential for substantial returns, making it a compelling option for investors seeking long-term growth. However, it is essential to understand the factors that contribute to this potential reward and the associated risks.

- Growth potential: The metal fabrication industry is expected to experience steady growth in the coming years, driven by increasing demand from various sectors such as construction, manufacturing, and infrastructure development. This growth translates to increased revenue and profit opportunities for publicly traded metal fabrication companies.

- Dividend income: Many publicly traded metal fabrication companies pay dividends to their shareholders, providing a regular stream of income. These dividends can supplement the potential capital gains from stock appreciation, enhancing the overall return on investment.

- Appreciation potential: The stock prices of publicly traded metal fabrication companies have the potential to appreciate over time, especially for companies with strong financial performance, innovative products, and a competitive market position. This appreciation can lead to significant capital gains for investors who hold their shares over the long term.

- Industry consolidation: The metal fabrication industry has experienced consolidation in recent years, with larger companies acquiring smaller ones to expand their market share and enhance their competitive advantage. This consolidation can create opportunities for investors to benefit from the growth and stability of larger, well-established companies.

It is important to note that the potential reward for investing in publicly traded metal fabrication companies is not guaranteed, and there are inherent risks involved. Investors should carefully consider their investment goals, risk tolerance, and investment horizon before making any investment decisions.

Impact

Publicly traded metal fabrication companies play a critical role in the global economy, shaping industries and driving economic growth. Their operations and products have far-reaching implications, extending beyond their immediate markets and touching various sectors worldwide.

- Infrastructure Development: Publicly traded metal fabrication companies are major suppliers of structural steel, plates, and other metal components used in the construction of bridges, buildings, and other infrastructure projects. Their products form the backbone of modern cities and transportation networks, facilitating economic activities and improving the quality of life.

- Manufacturing and Production: Metal fabrication companies provide essential components and machinery for various manufacturing industries, including automotive, aerospace, and energy. Their products are crucial for the production of vehicles, aircraft, and equipment, contributing to global supply chains and economic output.

- Energy and Utilities: Publicly traded metal fabrication companies supply specialized metal products and services to the energy and utilities sectors. Their involvement in the fabrication of pipelines, power transmission towers, and renewable energy systems supports the delivery of reliable and sustainable energy sources.

- Global Trade and Commerce: The products and services of publicly traded metal fabrication companies facilitate global trade and commerce. They export their products to countries around the world, supporting international supply chains and economic interdependence. Their operations contribute to foreign exchange earnings and overall economic growth.

In summary, publicly traded metal fabrication companies are not only key players in their industry but also significant contributors to the global economy. Their impact extends far beyond their immediate operations, influencing infrastructure development, manufacturing, energy, and global trade. Understanding their role provides a deeper appreciation of the interconnectedness of the global economy and the importance of metal fabrication in shaping our world.

FAQs on Publicly Traded Metal Fabrication Companies

This section addresses frequently asked questions about publicly traded metal fabrication companies, providing clear and informative answers to common concerns and misconceptions.

Question 1: What are publicly traded metal fabrication companies?

Publicly traded metal fabrication companies are businesses engaged in the fabrication and processing of metal products that are listed on stock exchanges, allowing their shares to be bought and sold by the public.

Question 2: What types of products and services do these companies offer?

Publicly traded metal fabrication companies offer a wide range of products and services, including structural steel, plates, fabricated metal components, cutting, welding, and forming services. These products are used in various industries such as construction, manufacturing, and energy.

Question 3: What are the advantages of investing in publicly traded metal fabrication companies?

Investing in publicly traded metal fabrication companies can offer potential advantages such as exposure to the growth in the metal fabrication industry, dividend income, stock appreciation, and opportunities for industry consolidation.

Question 4: What are the risks associated with investing in these companies?

Investing in publicly traded metal fabrication companies involves risks such as economic downturns, industry competition, fluctuations in raw material costs, and technological advancements that can disrupt existing business models.

Question 5: How can investors evaluate publicly traded metal fabrication companies?

To evaluate publicly traded metal fabrication companies, investors should consider factors such as financial performance, industry trends, competitive landscape, management experience, and growth potential. Thorough research and due diligence are crucial.

Question 6: What is the impact of publicly traded metal fabrication companies on the economy?

Publicly traded metal fabrication companies play a significant role in the global economy, contributing to infrastructure development, manufacturing, energy and utilities, and global trade. Their products and services are essential for economic growth and the functioning of modern society.

In summary, publicly traded metal fabrication companies offer investment opportunities with potential rewards and associated risks. Understanding the industry dynamics, evaluating companies thoroughly, and considering both advantages and risks is crucial for informed investment decisions.

Transition to the next article section:

Tips for Engaging with Publicly Traded Metal Fabrication Companies

Engaging with publicly traded metal fabrication companies requires a strategic approach to maximize benefits and mitigate risks. Here are some valuable tips to consider:

Tip 1: Research thoroughly: Before initiating any engagement, conduct comprehensive research on the company’s financial performance, industry standing, and market reputation. This will provide a solid foundation for informed decision-making.

Tip 2: Establish clear goals: Determine the specific objectives you aim to achieve through engagement. Whether seeking investment opportunities, exploring partnerships, or monitoring industry trends, your approach and interactions.

Tip 3: Identify key personnel: Establish contact with key decision-makers within the company. Research their backgrounds, areas of expertise, and responsibilities to ensure you engage with the most relevant individuals.

Tip 4: Prepare value propositions: When reaching out to publicly traded metal fabrication companies, clearly articulate the value your organization brings. Highlight your unique capabilities, expertise, or market insights that align with their business needs.

Tip 5: Be persistent and professional: Engaging with publicly traded companies can require patience and persistence. Maintain a professional and respectful demeanor throughout the process, even if you do not receive immediate responses.

Tip 6: Leverage industry events: Attending industry conferences and trade shows provides an excellent platform to connect with representatives from publicly traded metal fabrication companies. Prepare elevator pitches and engage in meaningful conversations to build relationships.

Tip 7: Monitor financial performance: Regularly track the financial performance of publicly traded metal fabrication companies you engage with. This will provide insights into their stability, growth potential, and any potential risks.

Tip 8: Seek professional advice: If necessary, consider seeking guidance from investment advisors, industry analysts, or legal counsel to navigate the complexities of engaging with publicly traded metal fabrication companies effectively.

By following these tips, you can effectively engage with publicly traded metal fabrication companies, build mutually beneficial relationships, and achieve your desired outcomes.

Transition to the article’s conclusion:

Conclusion

Publicly traded metal fabrication companies play a pivotal role in the global economy, providing essential products and services that underpin industries and infrastructure worldwide. Their operations have far-reaching implications, contributing to economic growth, job creation, and the advancement of modern society.

Investing in these companies offers potential rewards and risks, and thorough research, due diligence, and a strategic approach are crucial for informed decision-making. By understanding the industry dynamics, evaluating companies thoroughly, and considering both advantages and risks, investors can navigate the complexities of this sector effectively.

Engaging with publicly traded metal fabrication companies requires a well-defined strategy and a professional demeanor. Establishing clear goals, identifying key personnel, and preparing value propositions will help you maximize the benefits of engagement while mitigating potential risks.

As the metal fabrication industry continues to evolve, publicly traded companies will undoubtedly play a significant role in shaping its future. Their ability to innovate, adapt to changing market demands, and embrace technological advancements will be critical to their long-term success and the prosperity of the industries they serve.